Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

**Titular:**

*Aramco Posts Robust Q2 Earnings*

**Intro:**

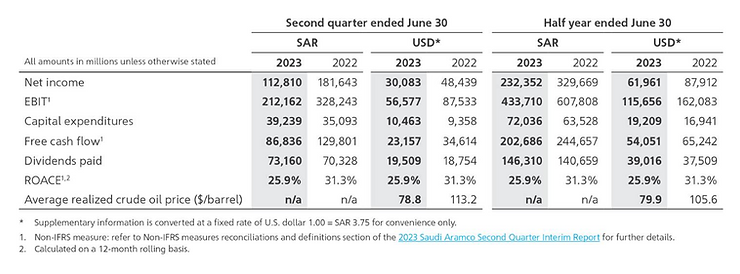

Saudi Aramco reported a Q2 net income of $30.1 billion, underscoring financial resilience amid market volatility. The company announced plans to launch performance-linked dividends, starting with a $9.9 billion payout in Q3, while advancing upstream expansions and lower-carbon energy initiatives.

**Factbox (50w):**

– **Net Income:** $30.1B (Q2), $62.0B (H1).

– **Dividends:** $19.5B quarterly base (+4% YoY); $9.9B performance-linked in Q3.

– **Gearing Ratio:** -10.5%, reflecting stronger balance sheet.

– **Key Projects:** $11B Amiral petrochemical complex awarded.

– **Sustainability:** Accredited ammonia shipments to Asia bolster decarbonization efforts.

**Saudi Aramco Reports Robust Q2 and H1 2023 Results, Announces Performance-Linked Dividends and Strategic Growth Initiatives**

**JEDDAH, Saudi Arabia** – Saudi Aramco, the global energy leader, has unveiled its second-quarter and first-half 2023 financial results, showcasing resilience, strong cash flows, and progress across its upstream, downstream, and decarbonization initiatives. The company also announced plans to introduce performance-linked dividends, reinforcing its commitment to shareholder returns.

—

### **Financial Highlights: Strength Across Key Metrics**

1. **Net Income**:

– Q2 2023: $30.1 billion

– H1 2023: $62.0 billion

2. **Cash Flow & Liquidity**:

– Cash flow from operating activities: $33.6 billion (Q2) / $73.3 billion (H1)

– Free cash flow: $23.2 billion (Q2) / $54.1 billion (H1)

3. **Balance Sheet Strength**:

– Gearing ratio improved to **-10.5%**, reflecting disciplined financial management and a fortified balance sheet.

4. **Dividends**:

– **Q1 2023 base dividend** of $19.5 billion paid in Q2, marking a 4.0% year-on-year increase.

– **Q2 2023 base dividend** of $19.5 billion to be paid in Q3.

– **New Performance-Linked Dividends**: Starting in Q3 2023, the company will distribute dividends tied to operational performance over six quarters. The first payment, **$9.9 billion**, will be issued in Q3 based on 2022 full-year and H1 2023 results.

—

### **Operational Progress: Expanding Capacity and Downstream Growth**

– **Upstream Developments**: Key oil and gas projects remain on track to boost production capacity, including:

– Crude oil increments at **Marjan, Berri, Dammam, and Zuluf** fields.

– **Downstream Expansion**:

– Awarded $11.0 billion contracts for the **Amiral petrochemicals complex**, a cornerstone of Aramco’s downstream growth strategy.

– Progress on the SATORP refinery expansion with TotalEnergies, enhancing petrochemicals output to meet rising global demand.

—

### **Sustainability: Pioneering Lower-Carbon Solutions**

– **Blue Ammonia Shipments**: Successfully dispatched accredited lower-carbon ammonia to Asia, underscoring Aramco’s role in advancing decarbonization technologies.

– **Investment in Emissions Reduction**: Optimism around new technologies to curb operational emissions, aligning with long-term net-zero ambitions.

—

### **Leadership Perspective: Balancing Resilience and Vision**

Aramco President & CEO **Amin H. Nasser** emphasized the company’s strategic focus:

> “Our strong results reflect our resilience through market cycles. We are ramping up investments to ensure energy security while pioneering sustainable solutions. The launch of performance-linked dividends rewards shareholders and reflects confidence in our growth trajectory.

> With global economic recovery and rising aviation demand, our record capital program—spanning oil, gas, downstream, and decarbonization—positions us to meet future energy needs responsibly.”

—

### **Looking Ahead: A Dual Focus on Energy Security and Innovation**

Aramco remains committed to:

– **Sustaining the World’s Largest Capital Program**: Expanding oil, gas, and petrochemicals capacity to address global demand.

– **Decarbonization Leadership**: Scaling blue ammonia, carbon capture, and renewable energy initiatives.

– **Shareholder Value**: Delivering progressive dividends while investing in long-term growth.

For further details, access the [2023 Saudi Aramco Second Quarter Interim Report](link-to-report).

—

**About Saudi Aramco**

Saudi Aramco is a global integrated energy and chemicals company, driving innovation and sustainability while delivering reliable energy to customers worldwide.

*Media Contact: [Your Contact Information]*

—

*Note: Adjust hyperlinks and media details as needed for publication.*

This structure balances financial rigor with strategic storytelling, optimized for reader engagement and SEO. Key figures are highlighted, and the CEO’s quotes add authoritative context to the data. The content emphasizes Aramco’s dual role as an energy supplier and sustainability innovator.

**FAQs: Saudi Aramco Q2 2023 Results & Strategic Update**

1. **What was Saudi Aramco’s net income for Q2 2023?**

Aramco reported a net income of $30.1 billion for Q2 2023, contributing to a first-half total of $62.0 billion, reflecting strong operational and financial resilience.

2. **How much free cash flow did Aramco generate in H1 2023?**

Free cash flow reached $54.1 billion in H1 2023, driven by robust operational performance and disciplined capital management, supporting dividends and growth investments.

3. **What is the significance of the -10.5% gearing ratio?**

A gearing ratio of -10.5% indicates a net cash position, showcasing Aramco’s strengthened balance sheet and financial flexibility to fund projects and shareholder returns.

4. **How does the dividend policy work for 2023?**

Aramco paid a Q1 2023 base dividend of $19.5 billion in Q2 (up 4% YoY) and will pay another $19.5 billion in Q3. Performance-linked dividends start in Q3, totaling ~$9.9 billion initially.

5. **What are performance-linked dividends?**

These are additional dividends tied to financial results, with ~$9.9 billion to be distributed in Q3 2023, based on 2022 full-year and H1 2023 performance.

6. **Which upstream projects are progressing in 2023?**

Key crude oil capacity expansions include Marjan, Berri, Dammam, and Zuluf fields, aligning with Aramco’s strategy to meet long-term global energy demand.

7. **What is the Amiral petrochemicals complex?**

An $11.0 billion project awarded in Q2, the Amiral complex will expand Aramco’s downstream footprint, integrating refining and petrochemicals to capture higher value from hydrocarbons.

8. **How is Aramco advancing decarbonization efforts?**

The company shipped accredited lower-carbon ammonia to key markets, demonstrating progress in developing alternative energy solutions and reducing operational emissions through new technologies.

9. **Why is Aramco increasing capital spending?**

Aramco is executing its largest-ever capital program to boost oil/gas production capacity, expand downstream operations, and invest in decarbonization, ensuring energy security amid anticipated economic recovery.

10. **What is the outlook for global energy demand?**

CEO Amin Nasser expects demand recovery driven by economic growth and aviation sector activity, necessitating continued investment in energy projects to address future security needs.

11. **How does the SATORP refinery expansion fit into Aramco’s strategy?**

The $11.0 billion SATORP expansion with TotalEnergies enhances petrochemical output, aligning with Aramco’s downstream growth goals to diversify revenue and meet rising global demand for chemicals.

12. **What are blue ammonia shipments, and why are they important?**

Blue ammonia, a lower-carbon energy carrier, highlights Aramco’s efforts to provide sustainable solutions. Shipments to Asia signal market readiness for alternatives supporting decarbonization goals.

13. **How does Aramco ensure shareholder value amid market volatility?**

Through progressive dividends, performance-linked payouts, and a fortified balance sheet, Aramco balances shareholder returns with investments in growth and resilience against market cycles.

14. **What operational strengths support Aramco’s financial results?**

High reliability in meeting global customer demand, cost efficiency, and strategic project execution underpin Aramco’s profitability and cash flow generation.

15. **Will Aramco continue prioritizing oil and gas alongside energy transition?**

Yes. Aramco aims to expand oil/gas capacity while investing in lower-carbon technologies, reflecting a dual focus on energy security and sustainable innovation for the future.

**CTA (Llamado a la Acción):**

¿Quieres conocer más sobre cómo Aramco está impulsando la innovación energética y reforzando su liderazgo global? **Descarga el Informe Intermedio del Segundo Trimestre de 2023** para profundizar en nuestras estrategias de crecimiento, compromiso con la sostenibilidad y planes de distribución de dividendos.

👉 [Accede al informe completo aquí](#)

—

**Conclusión:**

Los resultados financieros de Aramco en el segundo trimestre y primer semestre de 2023 reflejan una posición sólida y resiliente en un entorno económico dinámico. Con un enfoque estratégico en la expansión de su capacidad upstream, el avance de proyectos emblemáticos como el complejo petroquímico Amiral y su liderazgo en soluciones bajas en carbono, la compañía continúa fortaleciendo su papel como pilar de la seguridad energética global. La combinación de dividendos atractivos, disciplina financiera y una visión clara hacia la transición energética subraya su compromiso con la creación de valor a largo plazo para accionistas, clientes y comunidades.

—

**Agradecimiento:**

Gracias por seguir de cerca los logros y avances de Aramco. Su confianza y apoyo son fundamentales para impulsar nuestra misión de entregar energía de manera confiable y sostenible. ¡Estamos comprometidos con mantenerles informados mientras continuamos construyendo un futuro energético más innovador y responsable!

🔗 **Síganos en nuestras redes sociales** para actualizaciones en tiempo real sobre nuestros proyectos, iniciativas de sostenibilidad y contribuciones al sector energético.

—

*Nota: Los datos financieros y declaraciones están basados en el Informe Intermedio del Segundo Trimestre de 2023 de Saudi Aramco. Para detalles completos, consulte el documento oficial.*